Cash Book and Bank Statement Guided Format and Example

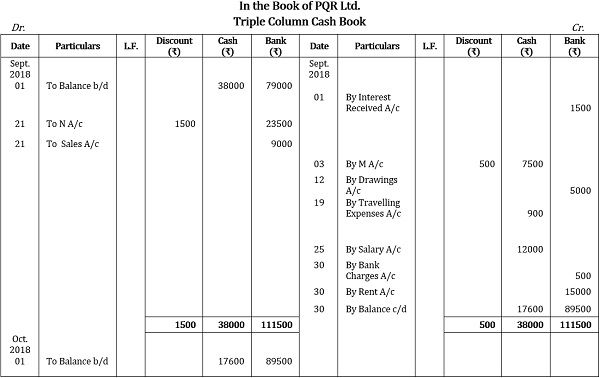

Then, the three-column cash book is the most detailed and comprehensive. It comprises three columns, each on the debit and credit side. One column has cash transactions, the second records bank transactions, and the third has transactions relating to discounts allowed and received. In general ledger, two separate accounts are maintained for discount allowed and discount received. The cash and bank columns of triple column cash book are used as accounts and are periodically totaled and balanced just like in case of a double column cash book. The P&G LLC records its cash and bank transactions in a triple column cash book.

Cash Book and Bank Statement: Explanation

Depending on how the transactions are recorded, a cash book can be either a debit or credit book. Businesses may use a cash book to track their income and expenses. Cash books come in a single column and can have an additional column. A cash book includes receipts and payments of cash, credit sales, and more.

Do you already work with a financial advisor?

When recording transactions in a cash book, many things need to be considered. For example, if money has been received, the description might be “Received in cash from client for a service.” The amount is the amount of the transaction. The financial balance of a real estate or personal ledger account that was carried over to the following accounting period is known as the Balance Carried Down (Bal c/d).

Posting a three column cash book to ledger accounts

In contrast, the right side or credit side contains cash payments. Bank transactions and discounts given for transactions are featured in separate ledger accounts in the case of single-column cash books. A triple column cash book is the most complex type of cash book.

- When the bank pays out cash against that cheque, it records the payment on the debit column of his statement of account.

- All items on the credit side of the cash book are posted to the debit of respective accounts in the ledger.

- Businesses use cash books to remain aware of their position with banks, while banks maintain records to ensure their position with an account holder is known.

- A cash book is a journal because all the cash and bank receipts and payments are documented in this book in a descriptive way, similar to journal posting.

Debits represent increases of value or asset accounts while credits represent decreases in value or liability accounts. A double column cash book is similar to a single column cash book, but it has two columns instead of one. This type of cash book is used by businesses who want to track each individual transaction in more detail. Double column cash books will show things like bank transaction details. Cash books are used to track the transactions between a business and its bank. This could include money that is received, paid out, and even deposited into or withdrawn from a bank account.

On the other hand, if debtors pay early, a discount may be allowed to them. The three common types of cash books are single-column, double-column, and triple-column. A bank statement refers to the list of entries to each account holder that have been made in their personal account, which is maintained by the bank. When the bank pays out cash against that cheque, it records the payment on the debit column of his statement of account. The first line of each entry shows date, name of customer (if any), account to be debited (positive amount) or credited (negative amount).

Also called a simple cash book, the single cash column records cash payments on the debit side (left side) and cash receipts on the credit side (right side). The entries about bank transactions and ledgers are on separate ledgers. Next, the two-column cash book has a debit and credit on each side. One column contains cash transactions, while the extra column notes transactions concerning discounts allowed or received. Discounts allowed are placed on the debit side, while discounts received will be on the credit side (they are an income).

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. For repaying the first information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. A financial professional will be in touch to help you shortly.

There are a few different types of cash books which all work slightly differently. The next section of this article will discuss more about each one. As this explanation indicates, the cash book is among the most important books of accounts in modern business. These headers are present for both the left side showing receipts and the right side showing payments. The Balance Brought Down and Balance Carried Down for bank accounts are the same as the cash amounts.

You may also like

- Pin Co Android için ücretsiz resmi uygulamayı indir

- А как выиграть в игорный дом, тактике а как обыграть игорный дом

- Jeetcity Gambling establishment Remark Why you ought to Play Right here

- Trang web cờ bạc trực tuyến tốt nhất có giao dịch thực Tiền tệ hàng đầu năm 2024

- Install Casibom app 💰 Get a bonus for sign up 💰 Huge catalog of casino games